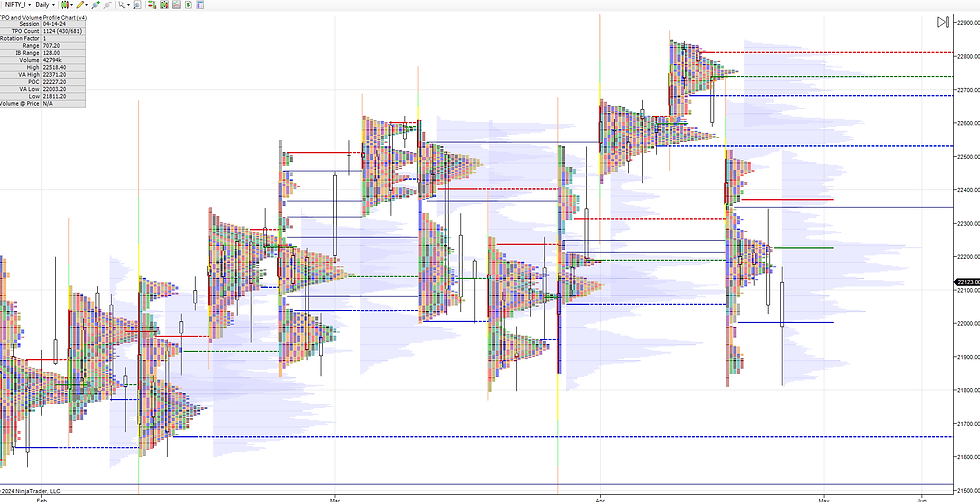

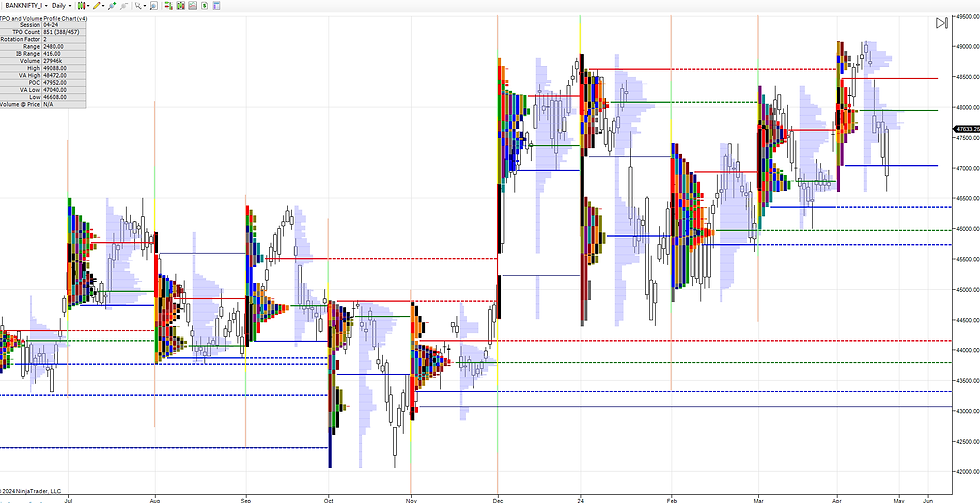

NF had FA top and got outside day + NE down day on expiry day.It opened up with large gap next then held the open and all day gone higher to close gap and test POC of NE downn day then closed at dPOC.

Triple distribution up trend day.

Buying tail saving Mar low.

dPOC skew higher into close on high volume day then closed there at dPOC. Volume is again good and all through the day supply was coming in to halt the move but got squeezed till close.

Data wise not much of long inventory at close from buyers. So, with this dPOC skew and close there, job of buyers if committed then defend 22080-22120 all session next and stay higher..Failing to do so could look for fill back into 3rd and 2nd disbn of this profile minimum.

Swing obj marked for 21950/21850-21800/21600 post that NE down day. NF probed till 21815 and bounced. 22340-22400 solid resistance upside still. Holding this band, looking for same balance to downside view to get 22050-22025/21940-21900/21850 again and sustains means move towards 21760/21650-21600.Swing bearish view off above 22400.

Levels wise, for next session move above 22150 could get 22180/22210/22240/22270 then reject else 22330/22360 probe possible. Not able to stay below 21900 and move above 21940 could fill 21970/22000/222040-22060. Upside if buyers fails to sustain above 22160 and moves below 22110 could get 22080 and weak below that for 22055/22020/21990 and quite weak below 21980 for 21950/21910/21860/21820.

Weekly :

NF got back to back tight balance week but closed below dVAL last week.

Staying below 22690 expected move is towards 22565/22475/22420 and below that marked move till 22260/22090-22060. NF gone for elongated week down with a move till 22815 then bounced and closed below dPOC.

Based on volume and structure of the week, either balance inside week or couple of days of balance then range extension down on weekly looking for. 22080 support for the week if wants to move higher to 22220-22260 then rejection possible to rotate down back to 22160/22080.Above 22260 could get 22340 if sustains bullish for 22400-22440/22500-22520. Weak below 22080 for 22025/21940/21890/21840 then bounce back in weekly range. If stays below 21840 then 21760/21650-21600 possible.

Monthly :

Apr gone for 6th month of one time frame up with DD up which has now given up lower disbn at 22420 and marking 3rd distribution down with clean extn from 22420. Reversal sign on monthly time frame. Holding below 22400 odds of fill back in 3rd disbn and stretch down further possible for remaining month. So, roughly 22350-21840 fill looking for in Apr and staying below 21840 opens up a move towards 21650-21600.Not moving to 21900 but moving higher above 22400 marks solid base in Monthly time frame then we could look for move higher towards 22520/22650/22850+

Charts and data :

Notes :

a) Check glossary page in website if any of the terms used in the post are not clear.

b) If images are not clear, click on them for enlarged view.

Comentarios