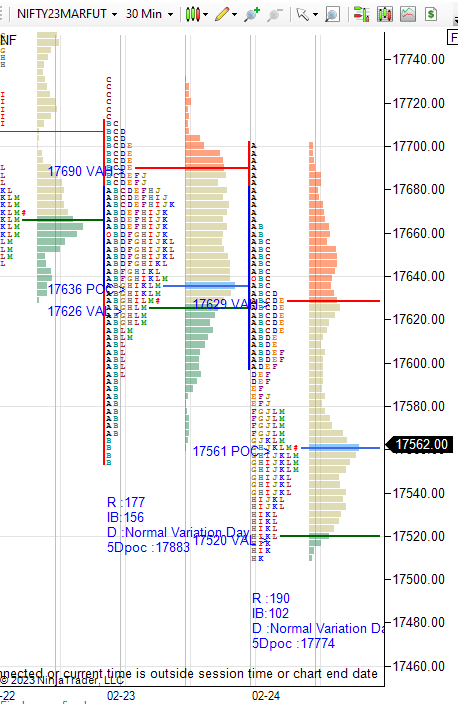

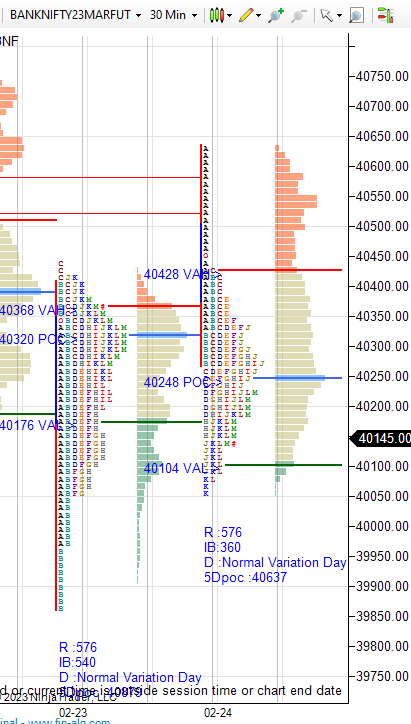

17700 considered as immediate resistance after Thursday auction..Failing to stay above 17640 expected drop to 17590/17540-17520.NF held below 17700 and left tail then all session moved down to probe till 17510 then closed at dPOC.

6th day of one time frame down via almost a trend day.

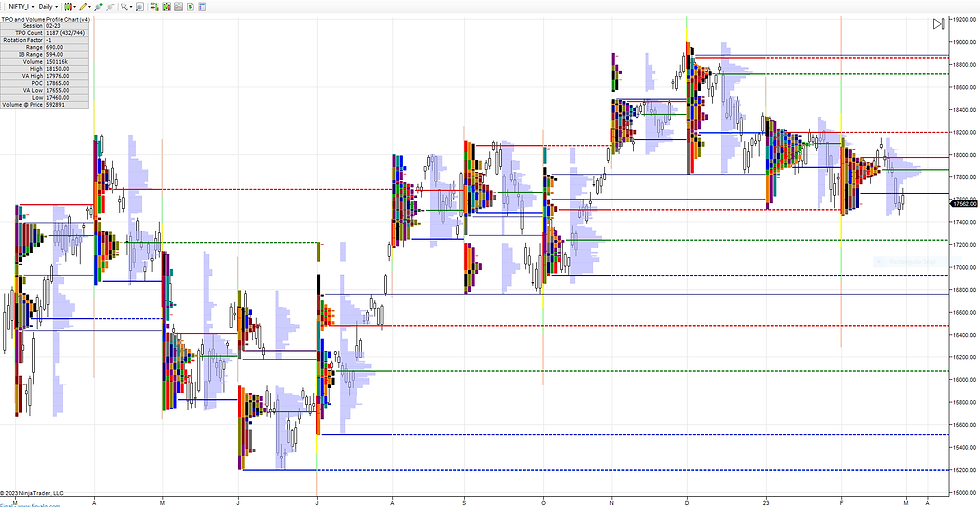

With adjustment of Mar contract, NF attempting below budget low and large balance in making. Left poor low also.

dPOC shift and close there..Next session sellers need to stay below 17580-17600 band and should get drive down or gap down then stay down with value..Else, we could balance in last two days range.

Mentioned in last report that looking for either straight downside holding below 17700 or one whip move to 17800-17850 then rotation down to move down further much lower from Feb low. Same view still. Bias is downside as long as no acceptance above 17850.

Levels wise for next session, failing to stay above 17600 could drop to 17550/17510 and weak below that for 17470-17450/17400/17350-17325 and more..Accepts 17600 and further moves above 17650 means should sustain with value..Failing to do so and dropping below 17580 could get 17550/17500 and more again.

If fails to stay below 17520 and moves above 17570 means buyers could attempt to get 17610-17620 if sustains bullish further for 17650-17660/17690-17710/17750-17770.

Swing short view for same obj already mentioned - 17450/17350/17150. Negation now moves to 17700.

View and levels on weekly/monthly time frame - available only to members.

Charts :

Daily

Weekly

Monthly

Data :

Detailed plan with references to carry forward, actionable trade hypos for next session, any importance nuance from the day and view based on weekly and monthly time frame are available to members in private blog.Above report is only part of it.

Notes :

a) Check glossary page in website if any of the terms used in the post are not clear.

b) If images are not clear, click on them for enlarged view.

Comments